The recent downgrade of U.S. debt by S&P did not come as a total surprise to the world. U.S. fiscal problems have been known for years. Over the last decade China has amassed enormous foreign reserves. Nearly 70% of China’s $3.2trillion in foreign reserves is in U.S. dollars, or U.S. dollar equivalents. To protect its assets, China can either diversify away from dollar assets or shrink its foreign reserves.

In the last few years China has started to diversify away from its dollar assets. The sheer size of its reserves, however, makes diversification nearly impossible. There is no market other than the U.S. Bond market, big enough to accommodate China’s foreign reserves. The German and UK bond markets total about $1trillion each. The Gold market is smaller than the bond market. The level of Chinese Gold reserve has not had any significant changes since September 2009. Other commodity markets are even smaller. Jesse Wang, deputy general manager of China Investment Corp (CIC), didn’t think that commodity markets are a viable option for China’s foreign reserves. Therefore, China’s recent stockpiling of many raw materials can be seen as a strategic industrial policy and not a fiscal policy.

In 2007 China used $200billion of its reserves to form a sovereign wealth fund, China Investment Corp. This fund’s investment objective is to seek investments with higher absolute returns than U.S. debt. Three years later CIC is heavy weighted in dollar-dominated assets, such as U.S. Treasuries, making its objective dubious. High profiled losses in the equity portion of their portfolio such as, Blackrock (BLK), Morgan Stanley (MS), and Tokyo Electric Power, have made their management cautious about moving beyond the safe haven of the U.S.bond market. Three-years of consecutive net losses have only reinforced this predisposition.

Diversification is good in theory, but after taking account of liquidity, risk-adjusted returns, and size, the U.S.bond market is still the best and safest place to park large amounts of money. A recent report by the Treasury Department has showed a month-over-month increase in Chinese purchases of U.S. treasury debt from April to June 2011, a reversal of China’s position of selling U.S. debt from October 2010 through March 2011. In contrast with the market in general, during the first half of 2011 China has increased its holdings on long-term agency bonds by about $10 Billion, mostly with Fannie Mae (FNMA.OB), Freddie Mac (FMCC.OB), and Ginnie Mae. China’s continued purchases have helped to ensure that U.S. mortgage rates have stayed at historic lows.

China other alternative of reducing its foreign reserves is equally problematic. Foreign reserves are a double-edged sword. China’s monetary policy stipulates that for every dollar increase in its foreign reserves, it has to inject approximately ¥6.4 into domestic circulation. Current data showed an increase of $31.4billion in Foreign Reserves in July 2011. Therefore according to Chinese policy, more than ¥202billion of new money should be pushed out into the economy in July alone. This fresh injection of liquidity will exacerbate a problem with increasing inflation. In, July inflation was at a 3- year high of 6.5%. As the majority of this inflation figure is made of consumer food price increases, it has disproportionally affected the poor and middle class, which has caused consumer confidence to dropped to 3-year low of 89.

Moderate and gradual RMB appreciation has been the approach of choice for China to reign in their foreign reserve problem. So far this has done little to contain the problem. It does not have discouraged net capital inflows, nor has it shrunk the current account surplus. “Hot money” continues pouring into the country. Since currency appreciation usually attracts more capital inflow in the short run, it has forced the RMB into a vicious circle of “appreciation-more inflow-appreciation.” Yet, China is unlikely to drastically appreciate its currency against the dollar to starve off the influx of “hot money.” This type of move would devastate the already fragile export sector. The average profit margins of Chinese exports are around 3-5%. An appreciation of the RMB by 5% would put the average export it into a negative territory.

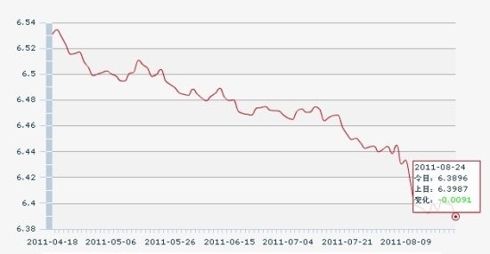

After the S&P downgrade of U.S. Treasuries, China accelerated the RMB appreciation and scored the third 100bps single-day increases in this month. At the rate of 6.389, the RMB has appreciated 29.43% since its currency reform in July 2005. It has appreciated 3.65% so far in 2011. However, experts are divided on whether China will continue pursuing aggressive RMB appreciation in the rest of 2011. In spite of RMB’s fast-rise against the dollar this year, its real effective exchange rate, as a weighted average of basket of currencies including the euro and yen, has actually depreciated, which has fueled robust exports to Europe and Japan.

Although the first six months of 2011 showed a decrease in China’s current account surplus, a surge in July pushed it to a 30-month high. China’s manufacturing sector continues favoring international customers over domestic buyers. In general, international buyers will pay cash in advance and buy in larger quantities. Some factory owners complain that domestic customers are more demanding, and often, they are not sure when or how much they will be paid. Discounts to international customers run as high as 20-30%. The price discrepancy between domestic and oversea retail price on the same “made in China” goods can be more 50%. A pair of Levi’s Jean sold in the U.S. for $30-50, will cost $150(¥1000) in China for the same pair. This raises the criticism that the current policies and industry practices shortchange the domestic consumer by subsidizing international sales.

In the post-downgrade era, safeguarding China’s vast foreign reserves has a renewed sense of urgency. Given the reserve’s size, the options are limited and problematic. For now, the dollar is still China’s best friend. As Chairman Hu said in his meeting with Vice President Biden recently, “we are in the same boat ... we will help each other out.”